am i taxed on stock dividends

The Most Popular Stocks at Dividend Stocks Rock. Why I Am a Dividend Growth Investor.

What Are Dividend Stocks How Do They Work Nextadvisor With Time

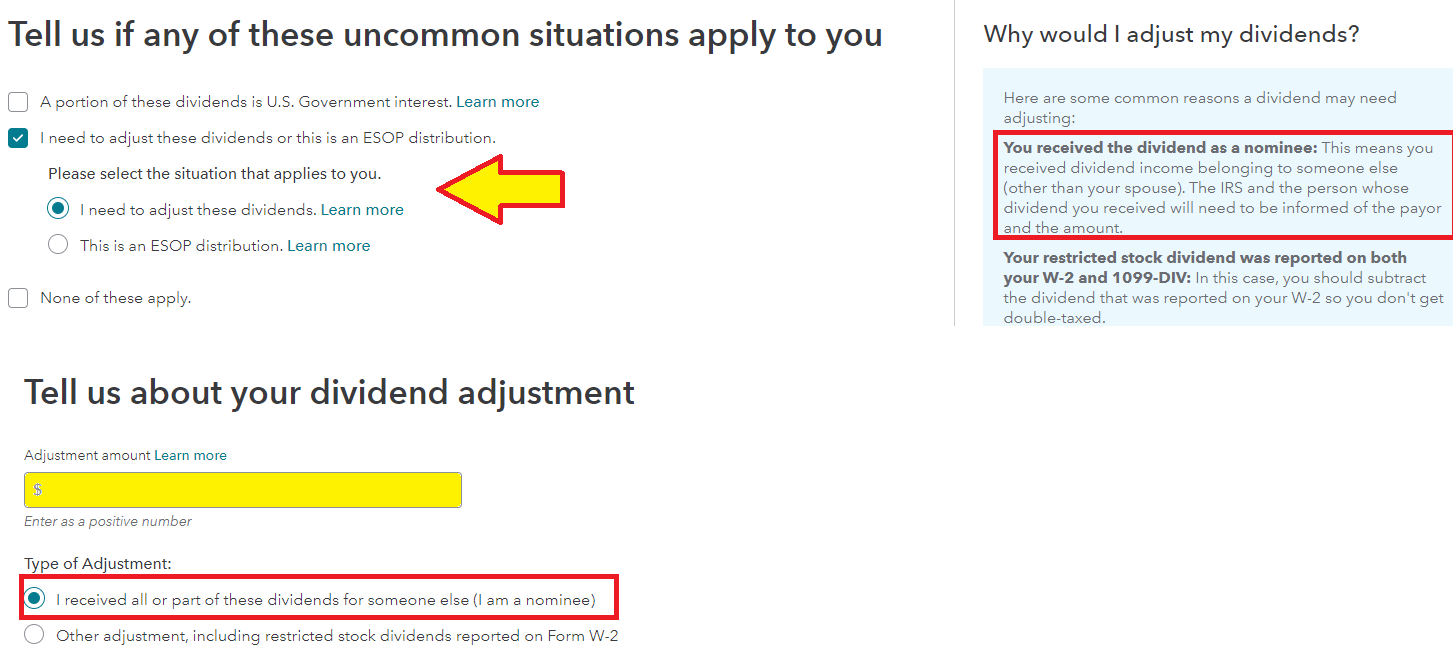

Am i taxed on stock dividends.

. Of the 895 hedge funds in our database 35 were long Chubb Limited NYSECB ranking the company 7. As an example I currently have 112 shares. Antero Midstreams next quarterly dividend payment of 02250 per share will be made to shareholders on Wednesday November 9 2022.

Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated. Ordinary dividends are taxed as ordinary income. However they are often confused on how PIK dividends are taxed.

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. The company has a debt-to-equity ratio. Non-Qualified Dividend Tax Rates for the 2022 Tax Year.

Even though only half of the capital gains are included in taxable income the. Capital gains are taxed at a rate of 50 in Canada and the investor must include this in their taxable income. 2 hours agoAs of 1025 Chubb Limited NYSECB has a dividend yield of 165.

Specifically you must record 488851 or more in taxable income as of the 2019 tax requirements. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. By The Dividend Guy Sep 21.

Dividends can be ordinary and taxed at the same rate as. The tax rules that apply to PIK dividends depend on whether the PIK dividend is paid on common stock or. The stock has a 50-day moving average price of 999 and a 200-day moving average price of 1007.

The best way to avoid taxes on dividends is to put dividend-earning stocks in a pre-tax retirement account. 915 on the next 46228. Shell SHEL 095 stock climbed Thursday as the British energy giant launched a 4 billion stock buyback program and revealed plans to hike its.

The next step down at a 15 rate is anyone who records 78751 to. Or qualifying foreign companies whose stock youve held for at least 61 days of a 121-day holding period. Qualified dividends come from investments in US.

The Stock Is Rising. 4 hours agoAM opened at 1030 on Thursday. Tax rate on dividends over the allowance.

Qualified dividends are taxed at. Back to AM Overview. By Dave Van Knapp Oct 13 2022 1111 AM EDT.

To work out your tax band add your total dividend income to your. Dividends are a portion of a companys profits paid to shareholders that can sometimes create double taxation.

What Are Dividends And How Do Stock Dividends Work

Publicly Traded Partnerships Tax Treatment Of Investors

Special Dividend Definition Rules And Impact On Stock Price

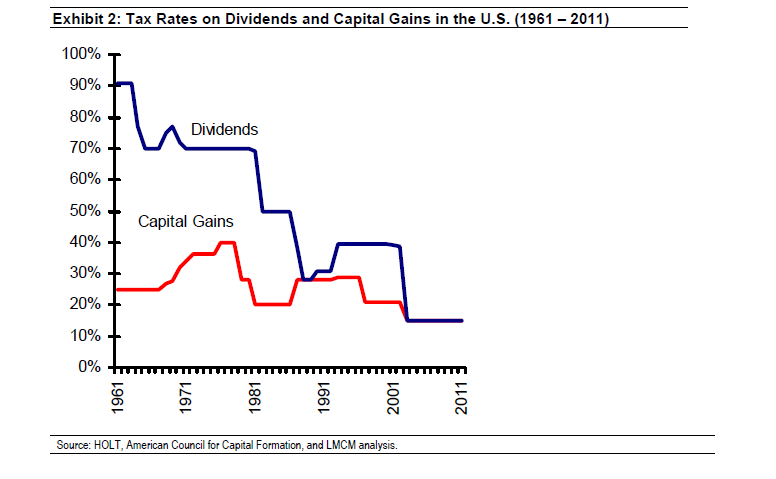

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

How Are Capital Gains Taxed Tax Policy Center

What Is A C Corporation What You Need To Know About C Corps Gusto

Understanding The Tax Implications Of Stock Trading Ally

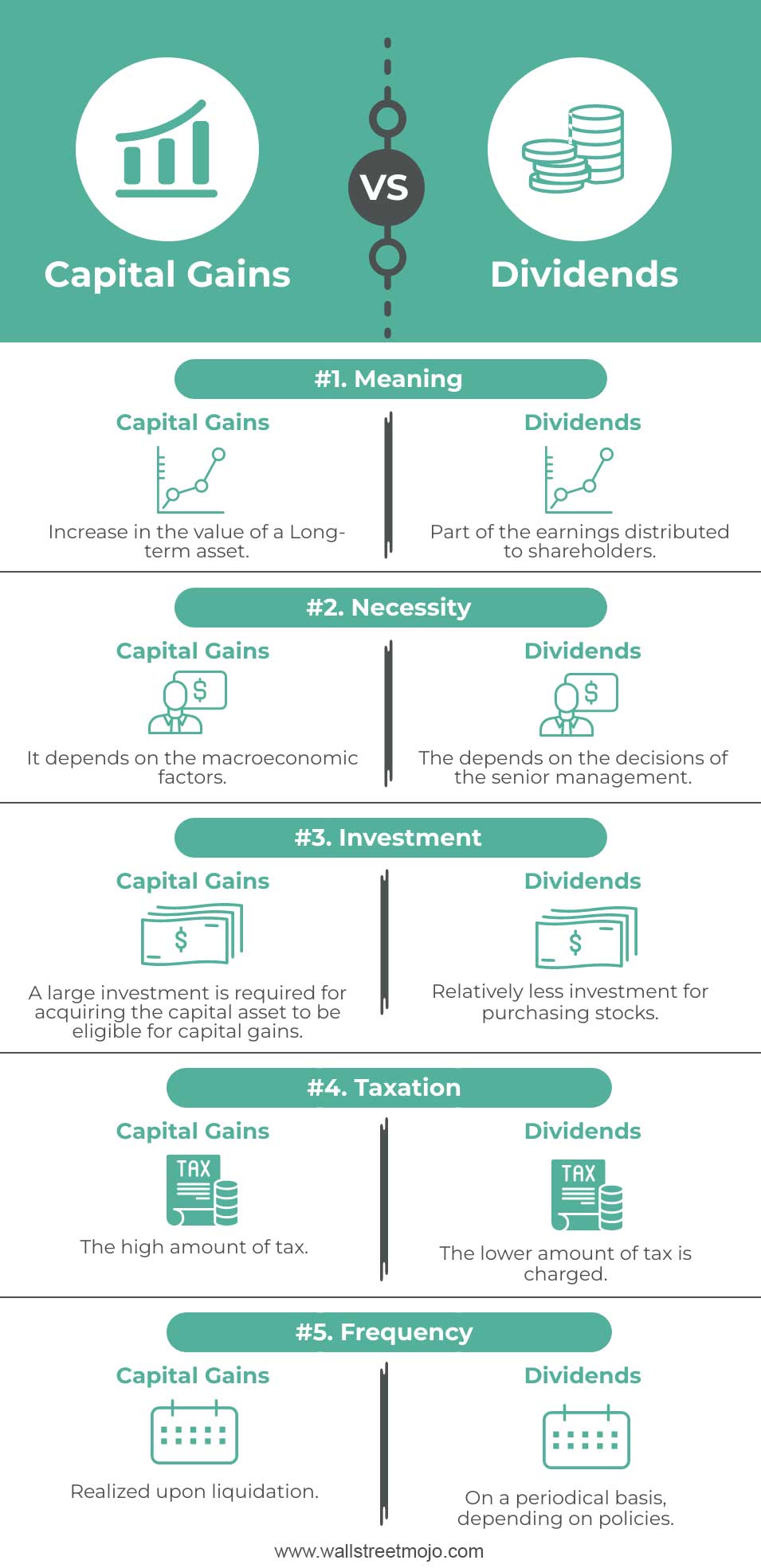

Capital Gains Vs Dividends Top 5 Differences Infographics

How Do State And Local Individual Income Taxes Work Tax Policy Center

How To Read Your Brokerage 1099 Tax Form Youtube

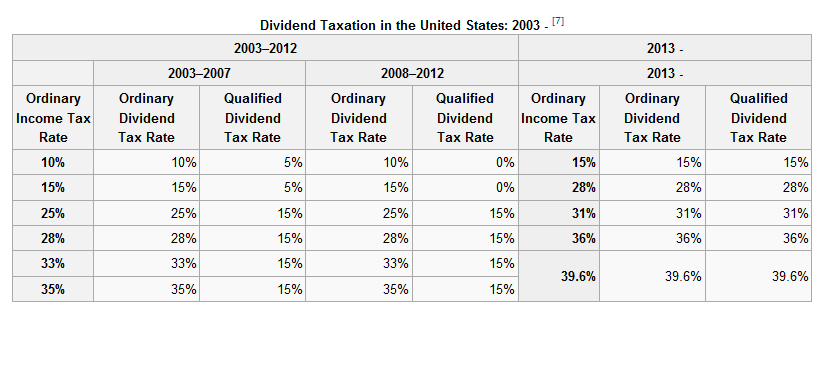

Capital Gains Tax In The United States Wikipedia

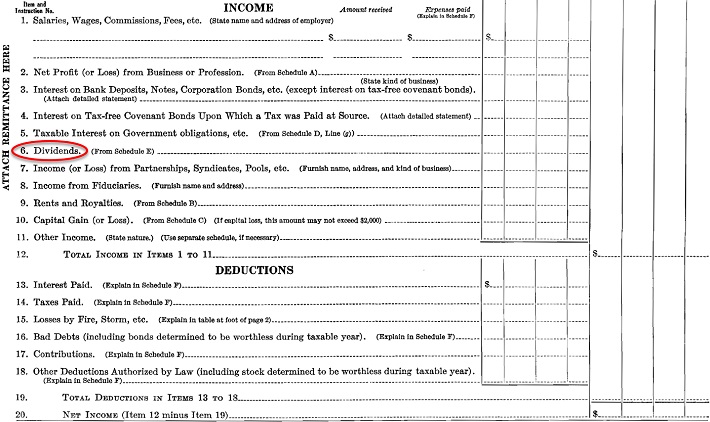

The History Of Dividend Taxation From 1913 To Now

U S Dividends And The Capital Gains Tax Rate Since 1961 Seeking Alpha

Tax Implications For Indian Residents Investing In The Us Stock Market

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World